Live below your mean and constantly build up investment portfolio is the key for financial freedom.

Saturday 27 October 2012

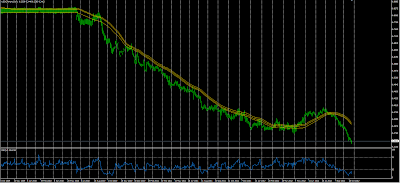

USD/CNH (USD vs Chinese Yuan)

This is D1 chart of USD vs Chinese Yuan currency pair from 2010 till 2012 (present).

Click on the picture to enlarge.

The strategy is simple enough! Do SELL every time you see it goes up! This trend is going to be there for the next few years, or until my further notice.

But in case I forgot to post here, look me up. Thanks. ^_^

Saturday 16 June 2012

Announcement

Hi all my respectful followers, thanks for your interest following my blog all this time.

But I am sadly to announce that, moving forward, I will only share my knowledge for those who subscribed to my service. If you would like to learn more, please send your inquiries through email to devthefut@hotmail.my (develop_the_future)

Best Regards,

Vincent Thong

But I am sadly to announce that, moving forward, I will only share my knowledge for those who subscribed to my service. If you would like to learn more, please send your inquiries through email to devthefut@hotmail.my (develop_the_future)

Best Regards,

Vincent Thong

Saturday 12 May 2012

Saturday 5 May 2012

AUSUSD week9

On 2/5/2012 Australia bank has announce to cut interest rate to 3.75%, because inflation is low, the economic growth is slow. This is a fundamental change, there is no hope for a rise at this AUD USD pair. I haven't close the position, and results in bigger loses. Anyway I will not hesitate to cut out loses on next market day (Monday), no matter what.

Friday 27 April 2012

AUD/USD week8, 1st Profit Taken

This week the AUD/USD raised. I have took the profit for the $0.10 lot size position. Making a profit of $9.30 dollar.

Below is the chart and the open position I remained. Let's see if next week it hit some major resistance, I will take profit again. Well, I earn the exchange rate and also the interest at the same time.

By the way, the results I posted here is just my mini account. I do have a standard account with CMC Markets, investing with similar strategy. That account makes very handsome money, at least to me. Because maybe got millionaire reading my blog, under 100k consider small amount maybe :p

so I don't post that account here.

By the way, the results I posted here is just my mini account. I do have a standard account with CMC Markets, investing with similar strategy. That account makes very handsome money, at least to me. Because maybe got millionaire reading my blog, under 100k consider small amount maybe :p

so I don't post that account here.

Friday 20 April 2012

Trading Update week7 on AUDUSD

AUDUSD closed at 1.0372 this week as shown in the daily chart below.

This week AUDUSD is going sideways, is a sign of trend reversal. Since there is a trade deficit risk in Australia, I don't expect the price can surge very high. I expect to close all the position at some price around 1.0500. In that case, 0.10 and 0.50 lot size positions would have made profits, just the 0.01 lot size position lost. Well, that is my strategy, first entry is a psycho test, so the lot size is small.

Let's see what happen next week.

This week AUDUSD is going sideways, is a sign of trend reversal. Since there is a trade deficit risk in Australia, I don't expect the price can surge very high. I expect to close all the position at some price around 1.0500. In that case, 0.10 and 0.50 lot size positions would have made profits, just the 0.01 lot size position lost. Well, that is my strategy, first entry is a psycho test, so the lot size is small.

Let's see what happen next week.

Saturday 14 April 2012

Trading Updates week6 on AUDUSD

My Trading Journal, AUD/USD pair:

Oh ya, forgot to mention about the red dotted line. The red dotted line is the TP (take profit). If the market hit that level, my 0.05 lot size opened position will be cashed out.

Today I take a look back on my first open position on this pair (AUDUSD), I just realized that it was opened since 6th March. I have been holding on this trade for 5-6weeks already. Well, nothing special though, I just thought time is flying.

Let's see how this pair performed in the last week. Here is the chart. A daily chart.

So, let me explain the horizontal lines and vertical lines I drawn on the chart.

The horizontal lines are the Fibonacci lines which acts as supports, and if you take a closer look at the green dotted lines, these are the entry long position I had made. And take a look at the bottom of the chart, where it shows my trading records. Look at the AUDUSD pair, then you will notice the first entry position I put is just 0.01 lot size, the next is 0.05 and subsequently is 0.10. This is my strategy to accumulate my position in a falling market.

Next, look at the vertical lines. The first red line is the time where market starts to fall, the second red line is the bottom of the fall (just based on my belief), and the yellow line drawn at May 28th should be the top of the rise. So all my open buying position should be cashed out sometime around before May 28th.

Well, what had happened to the markets in the last week? Hmm... nothing strange, everything looked just as expected. So, nothing to comment here. See you next week!

Oh ya, forgot to mention about the red dotted line. The red dotted line is the TP (take profit). If the market hit that level, my 0.05 lot size opened position will be cashed out.

Ok, let's see how this AUDUSD pair performs in the next week. See you again!

Saturday 7 April 2012

Forex Personal Report

I have been trading Forex since 2009. It has been 3 years now from, in these 3 years, I burst several accounts and lost quite significant amount of money. After going through all the ups and downs, I got improved, more seasoned, and I finally able to made money sometime last year. This is life changing milestone. I am reshaped and redefined the strategy based on my experience and cosy lessons. Here is my trading report.

See, this is my new account which started last year early-November, now is mid-April, I have been trading for 5 months. I made 13% (USD82 / USD600), wasn't that bad isn't it?

These few weeks I interested in AUD/USD pair. From my theory, It should have reached it's bottom already. I have been accumulating this pair for few weeks. Let's get back to this picture next week or next month to see what happened.

See, this is my new account which started last year early-November, now is mid-April, I have been trading for 5 months. I made 13% (USD82 / USD600), wasn't that bad isn't it?

These few weeks I interested in AUD/USD pair. From my theory, It should have reached it's bottom already. I have been accumulating this pair for few weeks. Let's get back to this picture next week or next month to see what happened.

Monday 26 March 2012

Caution

CAUTION. I met a young guy read stock's news at Larking bus station during my journey from Singapore to Labis. I heard someone chatting about stock in a lift. I received many many newsletter from brokers promoting stocks. What this means to me is that peak of the stock price is not far away.

I am hereby to announce that market is now in the last wave of economic cycle. Which means that most of the stock will rise, regardless of it's fundamental prospect. The period is, based on my experience, would be between 6-12 months long. Significant bad news bound to occur after 6 months and not longer than 12 months.

At this current market, I will not purchase any more stocks, but I will not sell either. Just do nothing. Within next 12 months, stock will soar and reached its peak (peak at ~June 2013), I will consider sell some stocks at June 2013 (should have some bad news by mid-2013). And then maybe ~June 2014, stocks reached its bottom. I will probably collect stocks from Jan-June 2014. This is my strategy for the next 2 years.

I may be cool at this blog now (no active blogging), because market is hot.

By the way, I will still try my best to answer any questions.

I am hereby to announce that market is now in the last wave of economic cycle. Which means that most of the stock will rise, regardless of it's fundamental prospect. The period is, based on my experience, would be between 6-12 months long. Significant bad news bound to occur after 6 months and not longer than 12 months.

At this current market, I will not purchase any more stocks, but I will not sell either. Just do nothing. Within next 12 months, stock will soar and reached its peak (peak at ~June 2013), I will consider sell some stocks at June 2013 (should have some bad news by mid-2013). And then maybe ~June 2014, stocks reached its bottom. I will probably collect stocks from Jan-June 2014. This is my strategy for the next 2 years.

I may be cool at this blog now (no active blogging), because market is hot.

By the way, I will still try my best to answer any questions.

Friday 24 February 2012

Stock of the Month (March 2012)

AGAIN!! UNDERVALUED STOCK

I have gone through my 2nd filter for around 1000 SGX stocks, and this one stands out.

The stock price is high now for most of the counters. It's getting harder and harder to find a counter that is worth buying.

1) Stock of the Month:

ChipEngS (C29)

2) Company Background:

Chip Eng Seng Corporation Pte Ltd was incorporated in Singapore on 23 October 1998. It changed its name to Chip Eng Seng Corporation Ltd on 3 November 1999 in line with the change of its status to a public limited company. The Group is currently engaged in building construction activities in public and private sectors and other construction-related activities, including civil engineering. Incidental to its main business, the Group also owns a few investment and development properties which include residential, industrial and commercial buildings. The Group's property development and investment arm has undertaken several development projects in Singapore and Australia, both on its own and with its partners.

3) Core Business/Revenue

The main source of income of ChipEngS is from Construction segment as shown in the figure below:

4) Company Update

Chairman's Message:

The Singapore government has announced new property cooling and stabilisation measures in January 2011, to stabilise home prices. This coupled with a more moderate and sustainable growth of 4-6% in the Singapore economy in 2011 is likely to impact market sentiments in the short term. Nonetheless, we remain positive on the long term outlook for the Singapore property market. We have built up a landbank of well-located sites. We believe that with their excellent locations and our track record in developing attractive homes, our projects will continue to find favour with home buyers and investors. The group will also continue to maintain a balanced and diversified portfolio of projects, locally and overseas. In February 2011, we launched Phase 1 or 150 units of our 301-unit condominium project, “My Manhattan” in Simei St 3. Depending on market conditions, we expect to launch our condominium project at Fort Road, our joint venture Executive Condominium project at Pasir Ris and our maiden DBSS project at Bedok Reservoir Crescent in 2011. In Australia, we will also launch a mixed-use project in Scarborough, Perth. Given our long standing track record in public housing, our Construction Division is well-positioned to gain from HDB’s building programme; in 2011, HDB expects to offer up to 22,000 new flats under the Build-To-Order Scheme, up from 17,700 flats in 2010. Our expanding precast division will also provide a new area of growth for our Construction Division.

13) Conclusion

This stock has superb EPS track record. I would say it is growing fast and strong. And it is too strong that government have to intervene the housing market. From my opinion, housing cooling measure is a good news, it means a steady growth in the market and that is quite promising. If you look at the Gross Dividend Per Share, it recorded a 4 cent per share where the share price is now 48 cents... almost 10 percent return solely on dividend payout! If you look at the 10 years history, the dividend payout is keep increasing! Take note that in the latest Quarterly Report (shown below), a sharp drop in net profit is seen, which is not recorded in the table above (col#12) because Annual Report 2011 haven't come out yet. The sharp drop is due to a change in accounting practice. Before the implementation of INT FRS 115, the revenue can be recognized before a construction project is completed. After the implementation of INT FRS 115 at 1st January 2011, the revenue can only be recognized after a construction project is completed. To me, this is just a matter of which year the revenue is to be recorded, there is no impact on company's profile. Well, the coming Annual Report is going to report a significant drop in net profit due to INT FRS 115 and may hurl away some superficial investors thus causes the share price to drop. ^.^ This provides a good entry opportunity.

Details on INT FRS 115 implementation:

http://www.asc.gov.sg/frs/attachments/2010/INT_FRS_115.pdf

14) Entry and Exit Strategy:

Recently, there is a significant buying volume to this counter (refer to the chart below). The gradual increase of stock price is because of gradual stock collection by managed funds (unit trust/investment holdings/etc). This is a normal practice in the stock market as investment holdings avoid market attention, so that they can soak up a significant amount of stock before the price is hot. Well, although there is a significant surge in price, but I believe this is not too late to get into the market looking at my intrinsic value of $0.98. Anyway, this surge of price gave me a confirmation that this counter is worth buying. I expect there will be some fluctuation on the price, but it wouldn't drop below $0.32. The strategy is easy for this counter, buy and hold forever! Unless you think Singapore housing market is not attractive any more.

I have gone through my 2nd filter for around 1000 SGX stocks, and this one stands out.

The stock price is high now for most of the counters. It's getting harder and harder to find a counter that is worth buying.

1) Stock of the Month:

ChipEngS (C29)

2) Company Background:

Chip Eng Seng Corporation Pte Ltd was incorporated in Singapore on 23 October 1998. It changed its name to Chip Eng Seng Corporation Ltd on 3 November 1999 in line with the change of its status to a public limited company. The Group is currently engaged in building construction activities in public and private sectors and other construction-related activities, including civil engineering. Incidental to its main business, the Group also owns a few investment and development properties which include residential, industrial and commercial buildings. The Group's property development and investment arm has undertaken several development projects in Singapore and Australia, both on its own and with its partners.

3) Core Business/Revenue

The main source of income of ChipEngS is from Construction segment as shown in the figure below:

4) Company Update

Chairman's Message:

The Singapore government has announced new property cooling and stabilisation measures in January 2011, to stabilise home prices. This coupled with a more moderate and sustainable growth of 4-6% in the Singapore economy in 2011 is likely to impact market sentiments in the short term. Nonetheless, we remain positive on the long term outlook for the Singapore property market. We have built up a landbank of well-located sites. We believe that with their excellent locations and our track record in developing attractive homes, our projects will continue to find favour with home buyers and investors. The group will also continue to maintain a balanced and diversified portfolio of projects, locally and overseas. In February 2011, we launched Phase 1 or 150 units of our 301-unit condominium project, “My Manhattan” in Simei St 3. Depending on market conditions, we expect to launch our condominium project at Fort Road, our joint venture Executive Condominium project at Pasir Ris and our maiden DBSS project at Bedok Reservoir Crescent in 2011. In Australia, we will also launch a mixed-use project in Scarborough, Perth. Given our long standing track record in public housing, our Construction Division is well-positioned to gain from HDB’s building programme; in 2011, HDB expects to offer up to 22,000 new flats under the Build-To-Order Scheme, up from 17,700 flats in 2010. Our expanding precast division will also provide a new area of growth for our Construction Division.

5) Market Cap: S$ 320.407M

6) Industry: Property and Construction

7) Company Type: Steady Growth (preferable to hold forever)

8) Current Trading Price :$0.48

9) Intrinsic Value: $0.98 (It should worth this price, I feel market is wrong, as it always does.)

10) Share Price Chart (5 years)

11) Insider Trade

| Announce Date | Date of Effective Change | Stock Name | Buyer / Seller Name | Type a | S / W / U b | Bought / (Sold) ('000) | Price ($) | Closing Price ($) d | After Trade | Note | |

| No. of Shares ('000) c | % Held c | ||||||||||

| 3-Oct-11 | 3-Oct-11 | ChipEngS | Chia Lee Meng Raymond | DIR | S | 100 | - | 0.335 | 20,827 | 3.145 |

Note

|

| 3-Oct-11 | 3-Oct-11 | ChipEngS | Goh Chee Wee | DIR | S | 14 | - | 0.335 | 1,136 | 0.172 |

Note

|

| 3-Oct-11 | 3-Oct-11 | ChipEngS | Hoon Tai Meng | DIR | S | 12 | - | 0.335 | 1,126 | 0.17 |

Note

|

| 3-Oct-11 | 3-Oct-11 | ChipEngS | Ang Mong Seng | DIR | S | 9 | - | 0.335 | 146 | 0.022 |

Note

|

| 1-Apr-11 | 1-Apr-11 | ChipEngS | Chia Lee Meng Raymond | DIR | S | 100 | - | 0.500 | 20,727 | 3.133 |

Note

|

| 1-Apr-11 | 1-Apr-11 | ChipEngS | Goh Chee Wee | DIR | S | 15 | - | 0.500 | 1,122 | 0.17 |

Note

|

| 1-Apr-11 | 1-Apr-11 | ChipEngS | Hoon Tai Meng | DIR | S | 13 | - | 0.500 | 1,114 | 0.168 |

Note

|

| 1-Apr-11 | 1-Apr-11 | ChipEngS | Ang Mong Seng | DIR | S | 9 | - | 0.500 | 137 | 0.021 |

Note

|

| 3-Jan-11 | 3-Jan-11 | ChipEngS | Chia Lee Meng Raymond | DIR | S | 300 | - | 0.455 | 20,627 | 3.12 |

Note

|

| 3-Jan-11 | 3-Jan-11 | ChipEngS | Goh Chee Wee | DIR | S | 44 | - | 0.455 | 1,107 | 0.167 |

Note

|

| 3-Jan-11 | 3-Jan-11 | ChipEngS | Hoon Tai Meng | DIR | S | 38 | - | 0.455 | 1,101 | 0.167 |

Note

|

| 3-Jan-11 | 3-Jan-11 | ChipEngS | Ang Mong Seng | DIR | S | 28 | - | 0.455 | 128 | 0.019 |

Note

|

12) Financial Data

| units in SGD '000 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

| Revenue | 477,030 | 376,435 | 354,591 | 201,174 | 165,058 | 99,799 | 141,768 | 159,770 | 176,015 | 140,327 |

| Profit Attributable To Shareholders | 109,688 | 75,271 | 43,899 | 50,345 | 14,718 | 11,277 | 10,440 | 8,498 | 3,960 | 1,517 |

| Historical EPS (cents) | 16.63 | 11.41 | 6.6600d | 8.08 | 2.43 | 1.86 | 1.83 | 1.73 | 0.81 | 0.31 |

| Gross Dividend Per Share (cents) | 4 | 3 | 0.75 | 0.75 | 0.75 | 0.75 | 0.75 | 0.5 | 0.25 | 0.25 |

| No. Of Ordinary Shares Issued ('000) | 659,515 | 659,515 | 659,515 | 659,515 | 606,789 | 606,789 | 606,789 | 492,360 | 490,480 | 490,000 |

| Reserves | 273,423 | 182,588 | 110,422 | 85,407 | 39,777 | 48,941 | 45,229 | 36,494 | 30,136 | 28,200 |

| Shareholders' Equity | 348,288 | 257,453 | 185,287 | 160,272 | 89,105 | 79,280 | 75,568 | 61,112 | 54,660 | 52,700 |

| NAV Per Share ($) | 0.5281 | 0.3904 | 0.2809 d | 0.243 | 0.1468 | 0.1307 | 0.1245 | 0.1241 | 0.1114 | 0.1076 |

| Price Earnings Ratio (PER) (Price/EPS) | 2.72 | 3.96 | 6.79 | 5.92 | 20.24 | 26.42 | 28.54 | 35.06 | 75.24 | 196.42 |

| Return On Equity (ROE) [%] | 31.493 | 29.237 | 23.692 | 31.412 | 16.518 | 14.224 | 13.815 | 13.906 | 7.245 | 2.879 |

| Debt To Equity Ratio | 1.117 | 1.004 | 1.704 | 0.929 | 1.419 | 1.159 | 1.688 | 1.752 | 2.098 | 1.357 |

13) Conclusion

This stock has superb EPS track record. I would say it is growing fast and strong. And it is too strong that government have to intervene the housing market. From my opinion, housing cooling measure is a good news, it means a steady growth in the market and that is quite promising. If you look at the Gross Dividend Per Share, it recorded a 4 cent per share where the share price is now 48 cents... almost 10 percent return solely on dividend payout! If you look at the 10 years history, the dividend payout is keep increasing! Take note that in the latest Quarterly Report (shown below), a sharp drop in net profit is seen, which is not recorded in the table above (col#12) because Annual Report 2011 haven't come out yet. The sharp drop is due to a change in accounting practice. Before the implementation of INT FRS 115, the revenue can be recognized before a construction project is completed. After the implementation of INT FRS 115 at 1st January 2011, the revenue can only be recognized after a construction project is completed. To me, this is just a matter of which year the revenue is to be recorded, there is no impact on company's profile. Well, the coming Annual Report is going to report a significant drop in net profit due to INT FRS 115 and may hurl away some superficial investors thus causes the share price to drop. ^.^ This provides a good entry opportunity.

Details on INT FRS 115 implementation:

http://www.asc.gov.sg/frs/attachments/2010/INT_FRS_115.pdf

14) Entry and Exit Strategy:

Recently, there is a significant buying volume to this counter (refer to the chart below). The gradual increase of stock price is because of gradual stock collection by managed funds (unit trust/investment holdings/etc). This is a normal practice in the stock market as investment holdings avoid market attention, so that they can soak up a significant amount of stock before the price is hot. Well, although there is a significant surge in price, but I believe this is not too late to get into the market looking at my intrinsic value of $0.98. Anyway, this surge of price gave me a confirmation that this counter is worth buying. I expect there will be some fluctuation on the price, but it wouldn't drop below $0.32. The strategy is easy for this counter, buy and hold forever! Unless you think Singapore housing market is not attractive any more.

Subscribe to:

Posts (Atom)